There's a fascinating new pattern emerging in the Venture Capital world that has been capturing much public and media interest. It's what the industry refers to as the "AI-powered roll-up," and it represents a genuinely novel approach to value creation that bridges the gap between private equity's operational rigor and venture capital's transformative ambitions.

For a quick read

Core Idea:

Applying the VC driven AI powered roll ups to public markets and identify candidates that fit the profile of labor-heavy, tech-light businesses, margin constrained businesses.

Why AI powered roll ups work:

Owning the asset enables deep AI integration (vs. just selling tools).

AI lifts margins from teens to 30–40%.

Valuation re-rating drives dual upside.

Public Market Potential:

Inefficient incumbents = ripe targets.

“Anchor” firms can acquire and scale AI across sector.

Challenges: short-term earnings pressure, cultural inertia, legacy tech.

Top Opportunities:

ManpowerGroup/TELUS Intl/CHRW/DXC

Key Value Drivers:

Margin expansion

Multiple re-rating

AI flywheel effect

Branding as “AI-first”

Execution Risks:

System overhauls

Culture change

Talent scarcity

Ongoing AI spend

The Strategy

At its core, this strategy is straightforward. Investors identify businesses that are heavy on labour and light on technology. Think call centres, document processing firms, or logistics companies. These businesses typically trade at modest valuations because their margins are compressed by high labour costs and manual processes. The acquirer then deploys artificial intelligence to automate significant portions of these workflows, dramatically improving the business's economics.

Where the proposition gets intriguing is when the cash flow improvement from these operational changes becomes the fuel for the next acquisition. It's a self-reinforcing cycle where better margins support higher valuations, which creates more capital for additional deals, which generates more opportunities for margin improvement.

Source: Finance Story, Tech Crunch, Financial Times

Why This Time Might Be Different

We've seen roll-up strategies before, of course. But what makes this AI-driven approach particularly compelling is the depth of transformation possible when you own the asset outright. As Elad Gil noted, “If you own the asset, you can [transform it] much more rapidly than if you’re just selling software as a vendor” (TechCrunch); a transformation that would be nearly impossible to achieve as an outside software vendor trying to sell tools to reluctant buyers.

The mathematics are compelling. If you can systematically take businesses with teens-level margins and transform them into 30-40% margin operations, you've created a powerful arbitrage opportunity. The market will eventually recognize this transformation through multiple expansion, creating value on two fronts: operational improvement and valuation re-rating.

The Public Market Opportunity

This brings us to an intriguing question: can this strategy work in public markets? The early evidence suggests it might, though with some important modifications.

Consider the landscape of public companies today. Many businesses in service-oriented sectors, from professional services to healthcare administration, still operate with surprisingly manual processes. They're often valued at modest multiples precisely because investors recognize their operational inefficiencies. These companies represent potential targets for either activist investors or strategic acquirers with the vision and capital to drive AI-enabled transformation.

There's also the "anchor platform" approach, where an existing public company uses AI to improve its own operations, then leverages the improved cash flows to acquire competitors. This creates a snowball effect where the strongest operator in an industry can systematically consolidate market share while improving industry-wide margins.

The Challenges Are Real

Of course, executing this strategy in public markets comes with unique challenges. Unlike private equity, public companies face quarterly earnings pressure, which can create tension between short-term results and long-term transformation investments. There's also the complexity of integrating AI into legacy systems and cultures, a process that's operationally demanding and culturally disruptive.

Capital structure considerations matter too. These transformations require significant upfront investment in technology development and potentially debt financing for acquisitions. Public investors need to be patient as management teams reinvest savings into new capabilities rather than maximizing immediate returns.

Following the Money

The investment community is taking notice. Several leading venture capital players have raised substantial funds specifically to pursue AI-driven acquisitions, and we're seeing public companies increasingly tout their AI initiatives as cost-reduction opportunities. Beyond Silicon Valley hype, it's a fundamental shift in how capital allocators think about technology's role in business transformation.

What's Driving the AI Roll-Up Revolution

Understanding why venture capitalists have suddenly embraced operational complexity requires examining two fundamental shifts that have rewritten the investment calculus entirely.

The Twin Catalysts of Change

For decades, venture capital maintained a clear doctrine: avoid anything that resembled traditional operations. The preference was always for asset-light, scalable software businesses that could achieve exponential growth without proportional increases in headcount. But two remarkable developments have changed this equation completely.

1. The Foundation Model Economics Revolution

The first catalyst is purely mathematical. Tasks that once required a dollar's worth of human labour can now be replicated for pennies in computational costs. More than just marginal improvements, it's a fundamental restructuring of the cost equation for knowledge work. When you can process documents, conduct initial customer interviews, or analyze financial data at a fraction of the traditional cost, you're not just improving efficiency; you're unlocking entirely new business models.

Consider the implications: a task that previously required hiring, training, and managing human workers now becomes a variable cost that scales perfectly with demand. The operational complexity that once scared investors has been transformed into a controllable, predictable expense.

Source: PwC, 2025 AI Jobs Barometer

2. The Private Equity Playbook Goes Mainstream

The second catalyst comes from an unexpected source: private equity's proven consolidation strategies. For years, PE firms have demonstrated that buying fragmented industries, eliminating redundant overhead, and methodically adding bolt-on acquisitions can generate superior returns to the venture capital approach of betting on breakthrough products.

What's changed is the marriage of this operational discipline with AI's transformative potential. Instead of just cutting costs through traditional efficiency measures, acquirers can now fundamentally reimagine how work gets done. The decision tree becomes elegantly simple: acquire a labour-intensive business, automate significant portions of its workflow, benefit from the margin expansion through higher valuations, then use the improved cash flows to fund the next acquisition.

This fusion creates a "PE Math with VC Narrative" investment methodology that blends the steady, compounding returns of private equity combined with the transformative growth story that excites venture investors.

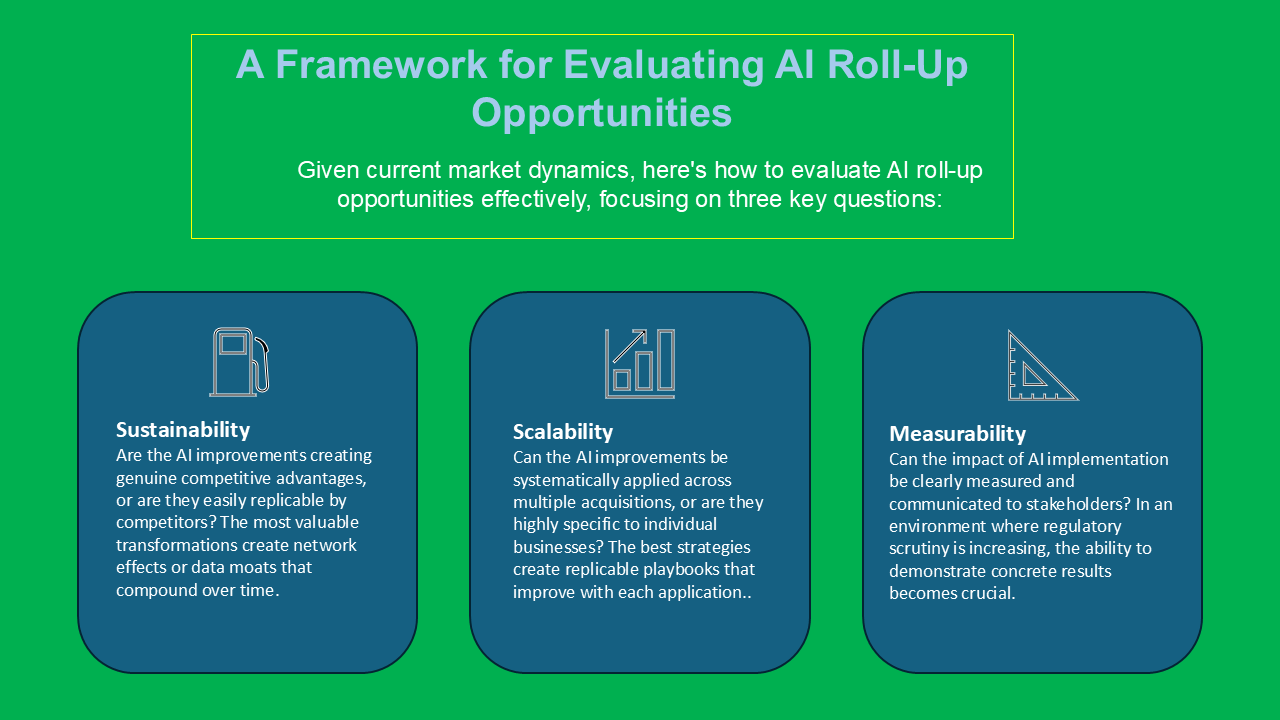

A Framework for Realistic Assessment

Before we get too caught up in the buzz surrounding AI-powered roll-ups, it’s worth taking a pause to unpack the mechanics. The top-line story: buy inefficient businesses, layer in automation, scale margins, sounds clean enough. But underneath that narrative lies a more nuanced profitability equation. The math can look compelling: improved gross margin, higher return on capital, multiple expansion. Still, execution is anything but plug-and-play.

The Upside Case: Four Vectors of Value Creation

Understanding the potential rewards requires breaking down the value creation into its component parts. Each vector operates differently and faces distinct challenges.

Operational Leverage: The Margin Expansion Engine

The most direct benefit comes from gross margin improvement. When AI can automate 10% of a business's workflows, companies typically see 300-800 basis points of margin expansion, across industries where routine tasks are being systematically automated.

But here's where the first challenge emerges: the law of diminishing returns applies ruthlessly. The initial automation targets are usually the most straightforward, repetitive tasks. Each subsequent wave of automation becomes more complex and delivers smaller incremental benefits. Moreover, in competitive markets, these cost savings are often shared with clients through lower prices, limiting the acquirer's ability to capture the full benefit.

Inadvertently, early movers may capture disproportionate benefits, but followers should expect more modest improvements.

Financial Engineering: The Multiple Expansion Play

Perhaps more intriguingly, markets are beginning to re-rate AI-enabled service businesses. Traditional service companies might trade at 7x EBITDA, but those with credible AI transformation stories are commanding at twice or higher valuations, a recognition that AI-driven operations represent a fundamentally different kind of business.

This creates a powerful arbitrage opportunity for acquirers who can buy traditional service businesses at modest multiples and transform them into AI-powered operations that command premium valuations. The value creation happens not just through operational improvements but through the market's recognition of the transformed business model.

The caveat is significant: markets are increasingly sophisticated about distinguishing between genuine transformation and AI marketing. The "hype decay" phenomenon means that companies need to produce audited evidence of their AI impact, not just compelling narratives. Street analysts are beginning to demand specifics about which processes have been automated and what the measurable impact has been.

The Compounding Effect: Flywheel Dynamics

The most powerful aspect of successful AI roll-ups is their self-reinforcing nature. Improved cash flows from the first acquisition fund subsequent deals, while the combined data from multiple businesses creates better AI models. This creates "flywheel cash" where each acquisition makes the next one more affordable and more effective.

The data network effects are particularly compelling. A company that owns multiple call centres, for instance, can train more sophisticated AI models than any single operation could develop independently. This creates a sustainable competitive advantage that compounds over time.

However, integration challenges multiply with each acquisition. The cultural and operational complexities of combining different businesses can create significant drag on the flywheel effect. What looks elegant in theory becomes messy in practice when you're trying to integrate disparate systems, cultures, and processes while simultaneously implementing AI transformation.

Narrative Capital: The Growth Story Premium

Finally, there's the power of narrative. Companies that can credibly claim to be "AI-native" or "AI-first" often trade like growth stocks even when their underlying businesses are cyclical or mature. This narrative premium can be substantial, effectively allowing traditional service businesses to access growth valuations.

The regulatory environment is evolving rapidly, though. The SEC is drafting new disclosure requirements for AI-related claims, and the risk of mis-selling AI capabilities is real. Companies that oversell their AI transformation face not just market disappointment but potential regulatory scrutiny.

The Sobering Reality Check

Here's where we need to inject some historical perspective. Conventional roll-up strategies have a mixed track record at best. Only about 33% of traditional roll-ups outperform their sector indices five years post-inception. The primary culprits are integration challenges, cultural mismatches, and the difficulty of achieving projected synergies.

AI roll-ups face all these traditional challenges plus additional complexity. While AI can expand the numerator (profit) through automation, it also inflates the denominator through technology capital expenditures, ongoing AI development costs, and increased governance requirements. The net effect isn't always positive.

The gap between strategy and execution is particularly wide in AI roll-ups. Consider the practical challenges:

Technical Integration: Implementing AI across legacy systems requires significant technical expertise and often complete system overhauls. Many service businesses have accumulated technical deficit over decades, making AI integration far more complex than anticipated.

Cultural Transformation: Moving from human-centric to AI-augmented operations requires fundamental changes in how employees think about their work. This cultural shift is often the most difficult aspect of the transformation and can take years to achieve.

Talent Acquisition: Successful AI implementation requires rare combinations of domain expertise and technical capability. Finding people who understand both the specific industry dynamics and AI implementation is challenging and expensive.

Ongoing Investment: AI systems require continuous investment in model training, data infrastructure, and system maintenance. These ongoing costs are often underestimated in initial business cases.

Industries Ripe for Transformation

With these catalysts in mind, certain sectors emerge as particularly attractive targets. The common thread among them is a combination of labour intensity, fragmentation, and resistance to technological adoption, characteristics that have historically limited their appeal but now represent significant opportunities.

Professional Services: The Knowledge Work Frontier

The legal and accounting professions represent perhaps the most compelling opportunity. These industries have remained stubbornly analogue despite decades of technological advancement. Law firms still deploy armies of associates for document review, contract drafting, and legal research. Work that AI can now handle with remarkable proficiency.

The economics are striking. A law firm that can use AI to handle 70% of document review tasks doesn't just save money; it fundamentally changes its cost structure. Similarly, accounting firms that automate routine data processing and report generation can begin to operate with margins resembling software companies rather than traditional service businesses. [Link my books - 40% of the time normally spent on manual data entry and up to 70% in reconciliation time can be saved. Top performers achieve margins of 25–30% or higher, approaching those of software companies.]

The fragmentation in these sectors creates additional opportunity. While the largest firms may be too established to acquire, the ecosystem of supporting services such as legal process outsourcing, e-discovery providers, compliance specialists, represents a collection of businesses that could be transformed and consolidated under AI-driven operations.

Staffing and Human Resources: Reimagining Talent Markets

The staffing industry embodies operational inefficiency at scale. With over 23,000 firms in the U.S. alone generating roughly $200 billion in revenue, the sector remains remarkably fragmented and labour-intensive. Most staffing agencies operate with razor-thin margins of 1-3%, limited by the manual effort required for resume screening, interviewing, and placement.

AI changes this equation entirely. An AI-powered staffing platform can conduct initial candidate interviews around the clock, evaluate fit with greater consistency, and automate much of the matching process. The transformation isn't just about efficiency, it's about creating a fundamentally different kind of service that can operate at much higher margins while delivering better outcomes.

Customer Support and Business Process Outsourcing: The Automation Wave

Call centres and back-office outsourcing operations represent another compelling target. These businesses have traditionally competed on labour arbitrage, moving operations to low-cost locations to maintain margins. AI offers a different path: instead of geographic arbitrage, companies can achieve cost advantages through technological leverage.

We are already seeing early evidence of this transformation. Companies report deploying AI to handle thousands of customer emails and chats automatically, freeing human representatives for complex issues. The margin improvement potential is substantial, and the fragmented nature of the industry creates numerous acquisition opportunities.

Healthcare Services: Navigating Regulatory Complexity

Healthcare administration presents a unique opportunity because regulatory requirements have created standardized processes that are ideal for AI automation. Revenue cycle management which involves a complex process of billing and collections for healthcare providers, runs thousands of repetitive tasks that AI can handle more accurately and efficiently than humans.

Companies like R1 RCM (privately held) are already partnering with AI providers to "reengineer labour-intensive processes such as coding, billing, and denials management." The goal is comprehensive automation that boosts efficiency and cash flow for healthcare providers, exactly the kind of margin improvement that makes roll-up strategies viable.

Logistics and Transportation: Physical Industries with Digital Opportunity

Even physical industries like logistics offer surprising opportunities for AI-driven transformation. Freight brokerage, despite being ultimately about moving physical goods, involves substantial white-collar work in matching shippers with carriers, negotiating rates, and managing logistics.

C.H. Robinson's experience provides a compelling case study. The company now uses AI to automatically process over 2,000 email quote requests daily, reducing response times from hours to minutes. This isn't just about efficiency, it's about enabling human staff to focus on higher-value work while dramatically improving the cost per transaction.

The Common Thread

What unites these opportunities is their combination of fragmentation, labour intensity, and technological underdevelopment. These aren't glamorous industries, but they represent enormous markets where AI can create genuine competitive advantages rather than marginal improvements.

The transformation potential is particularly compelling because it's not dependent on breakthrough innovations or market timing. Instead, it relies on the systematic application of existing AI capabilities to improve well-understood business processes. For investors, this represents a more predictable path to value creation than betting on unproven technologies or uncertain market adoption.

Sifting for AI-Roll-Up Targets in Public Markets

If we accept the premise that venture capital has become a laboratory for testing new business models, then the recent wave of AI-driven roll-up plays such as Crete PA [Platform (a network of CPA firms) | Modernizes (their operational backbone) | Acquire-to-Automate (using AI to drive efficiency post-acquisition)] and Enam Co. [Aggregator (of service firms) | Transforms (inefficient operations) | Margin-Expansion Flywheel (AI‑powered roll-up strategy)], offers more than anecdote. They offer a signal.

These deals don’t just showcase the power of AI. They illustrate a repeatable strategy: identify labour-intensive, margin-thin businesses; inject automation to improve operating leverage; and scale via acquisition in fragmented markets. In essence, it’s a form of consolidation arbitrage, supercharged by general-purpose AI.

As a public equity investor, the question for me is to see if there are investable opportunities where this playbook can be ported profitably to public markets?

To answer it, I developed a two-stage screen.

First, I isolated companies exhibiting what I call "AI-roll-up DNA"—the same characteristics present in recent private-market plays. Second, I layered in public-market constraints: liquidity, balance-sheet flexibility, governance considerations, and valuation. The outcome is a shortlist of public companies that mirror the opportunity profile of those early-stage VC deals with a few bonus features: real revenues, listed disclosures, and the ability to scale via M&A immediately.

The VC Blueprint: Common Traits in AI Roll-Ups

What do these venture-backed roll-ups share in common? A surprising amount.

Each targets labour-heavy workflows that AI can transform; think thousands of people processing language, structured data, or repetitive rules-based tasks. Margins tend to be low, suggesting ample room for improvement. Their customer bases are fragmented, meaning a successful operator can stitch together demand while extracting economies of scale. Critically, many of these firms have already begun piloting AI, signaling both technical readiness and cultural openness to change.

I distilled these signals into six core traits and developed a screener for eligible AI roll up candidates, by attribute:

High labour intensity, especially in data or language tasks

Low EBITDA margins

Proprietary data sources

Fragmented customer ecosystems

Active AI experimentation

Depressed public valuations

Companies that made the Cut

I have picked names from this screen that share a common pattern: operational inefficiency meets digital potential, in sectors ripe for roll-up and ripe for transformation. They are mostly U.S.-listed, that fit the criteria of being operationally inefficient, labour-intensive, margin-constrained, yet potentially very improvable with AI. These companies are generally profitable or on a clear path to profit and trade at reasonable valuations that a strategic acquirer or activist could find attractive. Each could either serve as a platform for an AI roll-up (acquiring smaller firms after transforming itself) or as a prime target to be taken private or merged by an AI-focused investor.

1. ManpowerGroup (MAN) - Staffing & Human Capital

What It Is: A global staffing giant matching employers and job seekers. Services include temp staffing, permanent placement, and workforce consulting.

Why It Fits: Recruiters spend countless hours scanning resumes, conducting interviews, and matching candidates, work that AI can augment or replace. Despite $18B in revenue, Manpower’s net margin remains under 1%.

Valuation Premise: The company trades at a modest 10–15x forward earnings and ~0.2x revenue. With even minimal AI-driven productivity gains, net margins could double or triple, creating large equity upside.

Strategic Rationale: Manpower could acquire niche staffing agencies and overlay its AI-driven candidate matching stack. This would create scale efficiencies and deepen its competitive moat in a low-margin industry.

2. TELUS International (TIXT) - Customer Experience (CX) + Data Services

What It Is: A digital CX outsourcer and AI data vendor, majority-owned by TELUS Corp. Services include customer support, IT ops, and content moderation.

Why It Fits: A duality exists: TI has both the labour exposure (tens of thousands of agents) and the AI capabilities (it built its own GenAI platform). Yet, it trades at depressed levels due to GenAI headwinds in its data labeling unit.

Valuation Premise: Trading near 1x sales and ~6–7x EBITDA, TI offers optionality: margin compression has already occurred. If AI tools can reverse that trend, the upside is significant.

Strategic Rationale: TI could consolidate smaller CX players or data service vendors and transition them onto its GenAI-enhanced service platform. This is a self-disruption opportunity that could turn TI into an AI-native CX roll-up.

3. C.H. Robinson (CHRW) - Freight Brokerage and Logistics

What It Is: One of the largest 3PL and freight brokerage firms in the world, facilitating the matching of shippers and carriers.

Why It Fits: Freight quotes, load tracking, and routing are inherently data-driven and prone to latency when done manually. CHRW’s recent rollout of LLM-driven quoting tools demonstrates how even legacy logistics firms can benefit from automation.

Valuation Premise: Trades at ~15-20x forward earnings with signs of margin uplift from recent AI initiatives. A 15% productivity boost has already been realized in core operations.

Strategic Rationale: With $17B+ in revenue, Robinson could consolidate regional 3PLs, implement its automation stack, and gain scale efficiencies—essentially executing a tech-enabled roll-up in freight brokerage.

4. DXC Technology (DXC) - IT Outsourcing and Consulting

What It Is: A $13B revenue provider of IT services, cloud migration, and workplace transformation, spun out of HPE/CSC.

Why It Fits: DXC has thousands of engineers performing legacy maintenance, system upgrades, and IT support. Tasks that can be enhanced or replaced by AI. Yet, it trades at only 0.5x revenue.

Valuation Premise: With margins at 3% and public scepticism high, any credible turnaround, especially one powered by AI, could re-rate the stock materially.

Strategic Rationale: DXC could pursue vertical consolidation: buying niche MSPs or automation vendors, absorbing them into a unified AI delivery model. Alternatively, it is a low-cost acquisition target for a private equity or cloud-native player seeking scale and clients.

Each of these companies presents a variation on the same theme: legacy inefficiency plus data-rich operations equals fertile ground for AI-powered transformation. The market may not fully reflect this embedded optionality. In that gap lies potential opportunity for investors who might have better appreciation for how capital cycles evolve when technology changes the unit economics of service delivery.

Perspective from the Other Side of the Table: Potential Anchors for AI Roll-Up Strategies

While the companies profiled above are potential beneficiaries of transformation, it’s equally important to understand who might be orchestrating that transformation. On the other end of the negotiation table sit firms with the capital, operational sophistication, and technological maturity to lead the AI roll-up wave.

Teleperformance (PAR: TEP) operates at a global scale few can match, over 400,000 employees delivering customer service and content moderation. Its AI readiness is real: more than 600 in-house AI specialists, and an explicit commitment to augment rather than replace human work. Despite recent investor unease around AI disruption, its ~15% EBITDA margin positions it well for opportunistic consolidation. If Teleperformance can use automation to undercut peers while maintaining service quality, it can aggregate smaller BPOs at accretive multiples. The market may be underestimating its capacity to lead this shift.

Accenture (NYSE: ACN) presents a different paradigm. With 700,000+ employees, premium margins, and a client roster that spans sectors and geographies, Accenture has scale as a structural advantage. It isn’t simply integrating AI, it’s training tens of thousands of consultants to deploy it. It acquires 20–30 firms annually, often niche specialists in cloud or AI. This enables a powerful flywheel: acquire domain expertise, apply best-in-class AI frameworks, then scale services globally. If roll-ups are about speed and repeatability, Accenture has both.

Genpact (NYSE: G) with its roots in GE and a Six Sigma culture, offers a hybrid of industrial discipline and tech ambition. Its approach to AI is practical: focused on finance and accounting, supply chains, and insurance. Genpact has already acquired AI firms and could deepen this strategy by rolling up BPO providers and infusing them with its automation toolkit. As clients look to cut costs and digitize operations, Genpact’s credibility and global delivery footprint can give it currency, both literally and figuratively, for roll-up expansion.

SS&C Technologies (Nasdaq: SSNC) brings a different lens. With a proven playbook of buying and integrating fund administrators and software vendors, SS&C is a natural consolidator. Its GoCentral platform and use of intelligent automation in fund administration provide a model for margin expansion. What makes SS&C compelling is its ability to apply software economics to what were once service-heavy businesses. If margins expand from 10% to 30% post-acquisition through automation, the value creation is enormous.

These potential acquirers are not just well-capitalized; they are well-positioned. They possess the technical acumen, cultural muscle, and M&A discipline to absorb inefficiencies and translate them into productivity. If the prior section mapped the terrain of who might be bought, this frames who’s likely to be buying and shaping tomorrow’s AI-augmented service landscape.

Cautious Optimism: Why AI Roll-Ups in Public Markets May Walk Before They Run

Yet I’d be remiss if I didn’t acknowledge the path via public markets may be slower and meandering than the venture headlines or private-equity case studies might suggest. Here’s why.

Can Public Companies Deliver PE-Style Profitability?

Private equity thrives in the 10–15% EBITDA range, often pushing margins into the 20s by stripping out overhead and automating back-office workflows. But many public companies don’t necessarily start with that luxury. Their baseline margins are far thinner, often below 5%, and for good reason.

Public-company status brings complexity: Sarbanes-Oxley compliance, union contracts, legacy systems, and investor relations overhead. You can’t simply gut the org chart and re-platform overnight. There are limits to how lean a public company can get while maintaining regulatory credibility and stakeholder alignment.

That said, the absolute dollars still matter. A four-point margin improvement on $3 billion in revenue doesn’t make headlines, but it does generate $120 million in new EBIT, enough to fund bolt-ons organically. In percentage terms, public firms may never touch software-like margins. But in scale-adjusted impact, the leverage is still real.

High Rates: Costly Debt, But Cheaper Equity

The current interest rate regime changes the calculus. SOFR-plus loans now clear north of 7%. A $1 billion LBO that looked elegant in 2021 might now require 250 basis points more to break even. For private equity, that’s a problem.

But in public markets, there's a subtle inversion: valuations have compressed. Many labor-heavy services businesses are trading below 6× EBITDA. If AI-driven efficiency lifts margins, the cash yield on equity still clears the higher cost of capital.

Still, I model deals under the assumption that high carry costs persist through 2026. Any investor expecting the Fed to bail out their underwriting math with rapid rate cuts is likely playing the wrong game.

The Looming Shadow of Regulation

If AI is the accelerant, regulation is the wet blanket and public companies are squarely in the line of sight.

Antitrust scrutiny has intensified. The FTC has already targeted serial acquirers in health services, and AI-enabled consolidation will only heighten that sensitivity. Add in labor optics: WARN notices, EU works councils, and job automation disclosures and even the most elegant operational plan can get caught in political crossfire.

There’s also a new layer emerging: AI governance. The SEC is preparing disclosure requirements around AI risk, and several states are considering laws around algorithmic bias. Public firms must navigate this with care. The bar for transparency is higher, and the downside associated risks (legal, reputational, operational) are not trivial.

A Healthy Dose of Scepticism

Even if the financial math checks out, there are non-trivial reasons to tread carefully.

Integration drag: Public companies don’t have the same agility as PE shops. Legacy ERPs, quarterly earnings pressure, and entrenched union rules slow down transformation timelines.

Commoditized AI: LLMs are improving, but they’re also commoditizing. The tech advantage that justifies an acquisition may erode before the target is even digested, let alone optimized.

Cultural resistance: Many workforces are habituated to hourly billing or project-based incentives. Swapping that out for productivity-based metrics sounds good in theory but change management is rarely that elegant.

Capital allocation bias: Boards often favour returning capital over deploying it. Shareholders who cheered your buyback might not cheer your next acquisition.

Roll-up reality check: History isn't kind to roll-ups. Even without AI complexity, two-thirds of roll-up strategies underperform their sector. The success rate improves with discipline, but never to certainty.

The Bottom Line

AI-powered roll-ups can work in public markets. But to believe they will, you must build your models with more humility than hubris. Expect thinner margin expansion than in private deals. Budget for higher capital costs and slower execution. And prepare for regulatory scrutiny not as a risk, but as a certainty.

Still, the asymmetry remains attractive. Taking a 3% net-margin business and lifting it to 10% on a multibillion-dollar revenue base is not just accretive. It’s transformative. But getting there requires something rare in public markets: patient capital, operational conviction, and a tolerance for friction.

Closing Thoughts: A Framework for Asymmetric Opportunity

The VC AI roll-up model, while forged in private markets, translates meaningfully to public equities albeit with more friction. Identify operationally inefficient firms, layer in automation, expand margins, and reinvest for scale. Where they differ primarily lies in pace, complexity, and public scrutiny.

AI-led automation inevitably leads to questions about headcount, labour optics, and regulatory posture. The winning firms will reframe this, redeploying human talent toward higher-order tasks while letting AI handle the procedural. It’s not just about cutting cost but also redesigning processes from the ground up. The prize isn’t marginal improvement. It’s a shift in the operating model.

And the economics speak for themselves. A company that expands margins from 5% to 20%, even without revenue growth, quadruples its earnings power. That cash flow becomes fuel: for investment, for buybacks, or more strategically, for acquiring smaller players and layering in AI from day one.

We’re already seeing glimmers of this: logistics firms growing margins despite top-line softness, BPOs maintaining growth through AI-enhanced offerings. We can expect that, in the next few years, earnings calls will begin to resemble playbooks, more CEOs openly discussing AI efficiency initiatives and hinting at inorganic expansion.

For investors, the edge lies in recognizing these patterns early. Screen for low-margin incumbents with scale, data, and repetitive workflows. Assess their AI readiness or their strategic value to someone who is. Then position accordingly: long the builders, and long (or ready to accumulate) the likely targets; steer clear of those neither adapting nor attracting.

I’m sharing information here to educate and inform, not to provide financial or investment advice. Like any other personal financial matter, your own due diligence is paramount.

Thanks for reading and sharing your insights! Also totally agree with the point on clean, well-organized data for AI to be effective. i think that also fully validates Meta’s price tag on Scale AI.

Recursive systems love using entropy to cut through waste and bloat. I did a field study with this at a company worked at the results were extremely telling. Knowing where to place resources and finding the legitimate pivot points is a game changer. Just the pesky matter of integrity weights via metadata stratification.