“Ability is important in our quest for success, but dependability is critical.” - Zig Ziglar

Executive Summary

In communications, the real value lies upstream. Apps, workflows, and AI-driven experiences may dazzle downstream, but they survive only when anchored to a resilient foundation. Most platforms build their nests on borrowed branches, orchestrating messages and calls while relying on someone else’s network. Bandwidth (NASDAQ: BAND) is different. It owns the tree itself, a licensed global carrier network, and is now shaping the orchestration layer on top, where enterprises can anchor their customer interactions, messaging, and AI integrations.

With Bandwidth, enterprises can choose from a long list of best-in-class technology leaders to simplify, de-risk and accelerate better customer and employee experiences. Source: PRNewswire

What makes this trajectory credible is not infrastructure alone, but leadership. Bandwidth’s culture has long resembled faith-based stewardship more than transactional management. Its founder-CEO has built with conviction, often prioritizing mission over optics, patient investment over short-term applause. That ethos matters in an industry where trust and reliability take years to compound. The market may see only debt and commoditized margins but underneath lies the scaffolding for a more enduring role.

While Bandwidth may be a licensed global communications carrier, its destiny may lie in becoming a software platform indispensable to enterprises navigating the next era of cloud and AI-driven communications. At roughly $15 per share, representing a market capitalization of about $450 million, the stock is priced as if the business has little future beyond survival. The valuation implies a company trapped in commoditized telecom margins, burdened by debt, and incapable of margin expansion.

But such a conclusion may be premature.

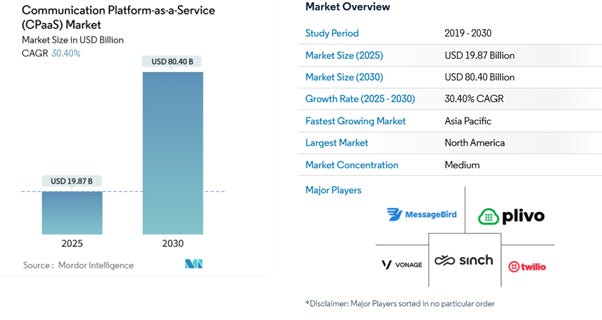

Bandwidth generates close to three-quarters of a billion dollars in annual revenue and ~$60 million in free cash flow, even after heavy investment in infrastructure and new products. On free cash flow terms the business trades at roughly 7x, and on sales at barely 0.6x, multiples that suggest distress rather than resilience. Yet the company operates in an industry projected to grow from about $20 billion in 2025 to more than $80 billion by 2030.

Bandwidth may be mispriced because the market sees only the present. A low-margin connectivity provider burdened by debt. What the market fails to recognize is the company’s transformation into a platform that can orchestrate communications for some of the largest enterprises in the world, while owning its own global telecom network. The endgame is not commodity pipes, but an intelligent control layer for voice, messaging, and AI integration.

On conservative assumptions, the base case is straightforward. If Bandwidth succeeds in repositioning itself as a high-value orchestration platform, helping enterprises manage all their communications workflows across multiple modalities, while maintaining the structural advantage of its owned global network, the company could viably compound revenues into the multi-billion-dollar range and free cash flow margins into the mid-teens %, as scale and mix effects kick in.

However, given the risks of financial leverage and the need for proof of execution, prudence dictates a small initial position if one buys the thesis. This provides exposure to the asymmetric upside while limiting potential loss if the thesis falters. Over time, as management proves its capacity to expand margins and reduce debt, conviction can grow and position size can expand.

Company Overview

A business built on connectivity

Bandwidth provides the underlying infrastructure that enables enterprises to embed voice calling, text messaging, and emergency services into their software applications. It is not a consumer brand. Its name is absent from the devices and apps that most people touch every day. Yet it is present in the background whenever a Zoom phone call reaches a landline, whenever a two-factor authentication text arrives from a bank, or whenever a healthcare provider initiates an emergency call over an IP line.

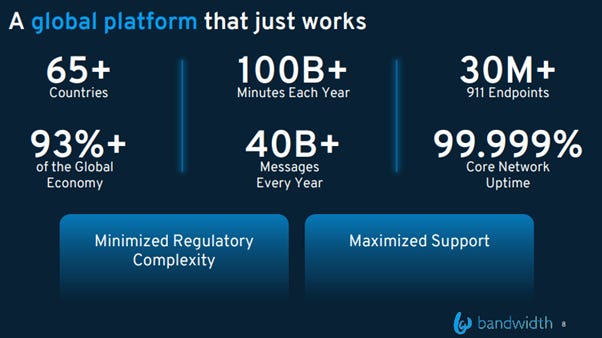

Bandwidth is an architecture of connection, providing enterprises with reliable, programmable access to the global communications fabric. That purpose is enduring, and it has been pursued by the company for more than two decades.

The company’s business model is a blend of usage-based and subscription revenues. Enterprises pay for voice minutes, text messages, and phone numbers, all accessible via Application Programming Interfaces (APIs) that developers integrate into their systems. In other words, Bandwidth is the programmable plumbing of enterprise communications. The core segments are global voice, programmable messaging, and emergency services.

Bandwidth was founded in 1999 by David Morken, then a Marine JAG officer building a start-up from his spare bedroom. For many years, it grew quietly, almost in defiance of the boom-and-bust cycles that preoccupied larger telecoms and Silicon Valley darlings. It went public in 2017, by which time it had already built something rare. A communications company that owned and operates its own underlying network infrastructure, unlike many of its competitors. At the same time, Bandwidth offered modern software interfaces that allowed developers to program communications into their applications. This dual identity of part carrier and part software company has shaped its competitive position ever since.

Bandwidth’s telecommunications network spans more than 60 countries and touches over 90% of global GDP regions. In practice, this means the company controls the pipes that carry the calls, the number inventory that assigns the digits, and the regulatory licences that authorize operations. By contrast, rivals such as Twilio lease access from other carriers.

This distinction is central. By operating as a carrier itself, Bandwidth ensures reliability, security, and lower latency. Its uptime hovers around 99.999 %, the five 9s critical for enterprise customers for whom dropped calls or downtime could mean lost business or regulatory breaches. It also means that at scale, Bandwidth can often offer prices 50% cheaper than intermediaries who must buy wholesale minutes. Customers such as Microsoft, Cisco, Zoom, and Amazon AWS recognised this advantage.

Industry Context and Market landscape

The company operates within the Communications-Platform-as-a-Service (CPaaS) industry. In plain terms, CPaaS is the provision of APIs, small blocks of code, that allow developers to embed communication functions into applications.

When a company like Zoom or Microsoft decides to use Bandwidth, their software developers take these specific tools and build them directly into the foundation of their own applications. Once that code is written and the application is running, Bandwidth is no longer just a supplier and becomes part of the customer's product. Moreover, the API becomes more than just code over time. It becomes integral to the customer's business logic and daily workflows. Call routing rules, messaging triggers, and emergency service protocols all become dependent on the specific functionality of Bandwidth's API. Removing it is not just a technical problem but a major operational disruption.

To switch to a competitor, the customer would have to assign expensive developers to a time-consuming and risky project of ripping out the old code and systematically remove all of Bandwidth's API calls, rewrite for new provider’s API and test extensively. This process can take months and thousands of developer hours, creating a powerful incentive for customers to simply stay with Bandwidth.

The market itself is undergoing one of those rare secular transformations that are not fads but shifts in industrial architecture. For decades, enterprise communication rested on rigid, hardware-heavy systems. Private branch exchanges, dedicated phone lines, costly maintenance contracts. These systems were capital-intensive, inflexible, and poorly suited to the globalised, mobile, and digital-first way that businesses now operate. The cloud has unbundled that model. Instead of buying boxes of equipment, enterprises now consume communication as a service, programmable through software APIs that can scale up or down instantly with demand.

This industry is large and growing. Market research estimates it at roughly $20 billion today, with a trajectory toward $70 billion to $80 billion by 2030, a compound annual growth rate of around 30%.

The drivers of this growth are not speculative. They are rooted in enduring needs. Remote and hybrid work has made digital communication indispensable. Consumers expect to be able to contact companies across multiple channels (voice, text, video) interchangeably. Enterprises want to integrate artificial intelligence into customer service, fraud detection, and real-time analytics. These are durable truths that extend beyond the quarter and decade.

All of these trends converge in the CPaaS model, where communications cease to be a siloed function and instead become woven into the digital fabric of enterprise workflows.

Bandwidth is one of a handful of players in this market. Twilio is the most widely recognized, thanks to its developer evangelism and broad product catalogue. Sinch, based in Europe, and Vonage, acquired by Ericsson, are other important names. Increasingly, the hyperscale cloud providers are also entering the fray with their own communications APIs.

The key differentiation is that most of these competitors are “over-the-top” providers, leasing capacity from carriers. Most software-centric CPaaS providers prefer to remain asset-light, reselling carrier services at a markup. Bandwidth’s ownership of its network positions it uniquely as a vertically integrated alternative. It built and operates its own global IP voice network, including the numbering resources, interconnection agreements, and switching capacity that allow it to deliver calls and texts directly into the public switched telephone network.

The customer base includes some of the largest names in technology, such as Microsoft, Google, Amazon, Zoom, Cisco, RingCentral. These clients depend on Bandwidth to underpin their own platforms, a testament to the trust it has earned. The top customers account for a meaningful share of revenue, which presents concentration risk, but also highlights the scale and mission-critical nature of the service provided.

The opportunity ahead is substantial. If Bandwidth maintains its niche as the enterprise-grade, carrier-backed provider while simultaneously building higher-value orchestration platforms, it can grow with the industry while deepening its moat. The market is large enough that even a few points of share translate into billions of dollars in revenue.

In short, the industry offers a rising tide, but it is not evenly distributed. Those who provide mere commodity minutes may struggle. Those who provide reliability, compliance, and orchestration at scale stand to become the indispensable platforms of the next decade.

Investment Thesis

Financial statements are necessary, but they rarely suffice on their own. Behind each number reflects a decision on pricing, on capital structure, on investment priorities. Isolating the number without the context can lead to partial conclusions. For Bandwidth, comparisons show gross margins trailing peers, leverage above average, and growth that lacks smoothness. Interpreted narrowly, this suggests a firm unlikely to command a premium multiple. The more useful question is whether those accounting signals align with or diverge from the company’s underlying economics.

The reality is that Bandwidth has chosen to depress gross margins today to widen its moat tomorrow. It has chosen to own and operate a network rather than remain a software intermediary. Building durable relationships with large enterprises, focusing on reliability, compliance, and tailored solutions, are the priority. As opposed to pursuing the broad but often transient pool of individual developers experimenting with APIs. And it has chosen to expand internationally via acquisition rather than remain parochial. These choices show up poorly in short-term metrics but underpin long-term endurance.

The case for owning Bandwidth rests on three enduring dynamics that, taken together, define its long-term trajectory.

Strategic Transformation toward a Higher-Value Platform

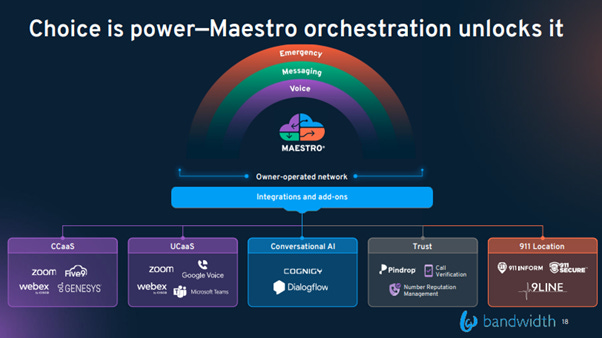

The first and most important point is that Bandwidth is not standing still. The company is deliberately repositioning itself from being seen as a low-margin vendor of voice minutes and SMS capacity into a software-enabled orchestrator of enterprise communications. This shift is embodied in its Maestro platform and its AIBridge service.

Maestro allows enterprises to integrate multiple carriers into a unified control layer, bringing their own carriers if they wish but using Bandwidth as the intelligence and orchestration hub. Instead of separate interfaces, compliance rules, and integrations in every geography, the enterprise gains one dashboard, one set of APIs, and one control point to manage its entire communications fabric worldwide.

This shift is not just about convenience. It alters the economics and resilience of enterprise communications. Companies can choose the most cost-efficient or compliant local carrier in each market without sacrificing global coordination. If a carrier suffers an outage or raises prices, Maestro can instantly reroute traffic elsewhere without forcing the enterprise to rebuild systems. Regulatory compliance, which varies across dozens of jurisdictions, becomes embedded at the orchestration layer rather than a burden for each IT team to manage.

Most importantly, Maestro positions Bandwidth not as one supplier among many, but as the conductor of the entire orchestra. A supplier sells you minutes and phone numbers. A conductor organizes the whole performance, ensuring every section plays in harmony. For an enterprise, the difference is profound. Instead of buying a commodity, they are entrusting Bandwidth with the intelligence of their global communication system.

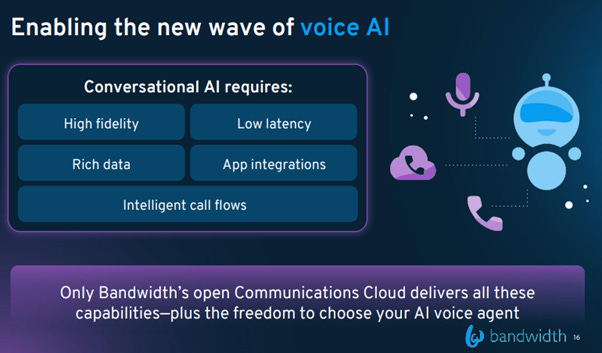

Looking forward, Maestro is also the gateway for AI in voice communications. Features like transcription, fraud detection, or real-time translation can be plugged directly into the call flow at the network level. Enterprises can trial and adopt these services without tearing apart their infrastructure. The value of such orchestration grows as communications become more complex, spanning more geographies, channels, and now AI layers.

This is the essence of Bandwidth’s repositioning. With Maestro, the company is no longer competing solely on price per minute or message. It is inserting itself as the indispensable layer that manages complexity, compliance, resilience for enterprises operating at global scale.

AIBridge meanwhile plugs into the growing world of voice-based artificial intelligence. Enterprises increasingly want to overlay AI services such as real-time transcription, fraud detection, voice sentiment analysis, onto calls. Enterprises can trial and adopt these services without tearing apart their infrastructure. By positioning itself at the network level as the enabler of these AI functions, Bandwidth moves up the value chain. An AI-enabled call can yield three to four times the revenue of a traditional call.

The market, however, has not priced in these shifts. Investors continue to value the company as if it were permanently stuck in commodity transport, ignoring the optionality embedded in these new products. The risk, of course, is that these initiatives fail to scale. But if they succeed, they will redefine the company’s margin profile and strategic importance.

Durable Advantage from an Owned Network

The second point is that Bandwidth’s owned and operated network, often cited as a weakness because it drags down gross margins, is in fact the cornerstone of its moat.

Owning the network means more than owning wires and switches. It means having direct interconnection agreements, regulatory licenses in multiple countries, and the ability to control quality end to end. For an enterprise customer, this translates into reliability and compliance. For Bandwidth, it translates into cost advantages at scale.

The infrastructure is costly. It requires capital, regulatory expertise, and years of effort to stitch together. This decision depresses gross margins. Bandwidth typically reports 38% to 40%, compared to fifty or more for asset-light peers but it also provides superior control over quality, pricing, and compliance. Enterprises that care about uptime, reliability, and regulatory assurance find this attractive.

To illustrate, consider a healthcare company whose patient communications must comply with strict federal regulations and whose services cannot tolerate downtime. Or a global video conferencing platform that must terminate millions of calls into phone lines across dozens of countries. For such customers, the cheapest provider may not be the best. What matters is trust; trust that calls will connect, numbers will port correctly, emergency services will function without fail. By owning the network, Bandwidth can offer this trust directly, without relying on third parties.

As the company grows, its cost per unit of traffic falls. Instead of pocketing all of that saving, it shares much of it with customers in the form of lower rates or better quality. Bandwidth’s competition as OTT providers is liable to margin squeezes if their carrier supplier raises prices. And they have only two choices. Either to absorb the cost and hurt their own profitability, or pass the price hike to their customers and risk losing them.

Source: prnewswire.com

For the largest enterprise contracts, where per-minute or per-message costs are driven down to fractions of a cent, controlling the marginal cost is everything. Bandwidth's marginal cost is near zero, giving them the flexibility to go far lower to win strategic, high-volume accounts that will be profitable over the long term. OTT providers have a hard floor on their pricing as they cannot profitably sell a service for less than what their carrier charges them.

The result is a deepening of the customer relationship and a reinforcement of loyalty. This reciprocity is evident in the company’s dollar-based net retention rate, which has consistently exceeded 100%. Customers spend more each year not because they are forced to, but because the value proposition keeps improving.

Critics point to the lower gross margins relative to “asset-light” peers like Twilio. Yet what those critics miss is that gross margin is not the summit but durable, growing cash flows underpinned by sticky customer relationships. If sacrificing a few hundred basis points of gross margin today earns decades of loyalty from enterprises like Microsoft, Zoom, and Cisco, then the trade is more than fair. It is in fact the essence of a compounding strategy.

Attractive Valuation with Multiple Paths to Win

The third point is valuation. At roughly $15 per share, Bandwidth’s market capitalisation sits around half a billion dollars. Enterprise value is just under a billion, implying multiples of less than 1x revenue and about 9x forward EBITDA. In the software and technology space, such valuations are reserved for companies in structural decline. Bandwidth, by contrast, is still growing revenue at high single to low double digits and generating positive free cash flow.

Peers tell the story. Twilio, growing more slowly and still struggling to achieve consistent profitability, trades at around 3x sales. Sinch, with its own struggles, also commands about 1x sales. Even mature telecom infrastructure providers often trade above 1x sales. On free cash flow, Bandwidth’s yield is in the low double digits, unusual for any technology company that is not in secular decline.

What this means is that expectations are extraordinarily low. The market is pricing Bandwidth as if it will never grow beyond its current scale and never improve margins. Any progress on either front; margin expansion from product mix, steady growth in revenue, or debt reduction could trigger a rerating. The asymmetry is stark. Downside is somewhat cushioned by current cash generation, while upside could be substantial if the company merely achieves industry-average valuation multiples.

Bringing the Three Points Together

A business that is repositioning itself to higher-value offerings, that enjoys a moat through ownership of its network, and that trades at depressed multiples despite positive cash generation, presents a rare combination. The transformation is not risk-free, but the odds are mispriced.

If Bandwidth succeeds in embedding itself as the orchestration hub of enterprise communications and AI voice, it could compound at rates that surprise the market. If it simply plods along, growing modestly and paying down debt, investors are still compensated by today’s low valuation.

This is not a prediction of perfection. It is an assessment that the range of plausible outcomes is skewed to the upside, while the current price implies pessimism bordering on dismissal. In such cases, patience becomes an ally.

Management & Culture

A company’s moat is often not just what it owns but who it trusts to build and defend it. In Bandwidth, unwavering leadership and a deeply felt culture converge to form exactly that.

David Morken, founder and CEO, is not typical Silicon Valley. A former Marine Corps JAG officer turned Ironman triathlete, his personal discipline and endurance shape the company’s ethos. His leadership is visibly mission-driven. Anchored by faith, steered by strategic patience, and directed toward long-term value creation. He famously continues to pray before pivotal moments, from IPO celebrations to company gatherings, believing the same resilience that enabled Bandwidth to weather downturns stems from a higher calling.

David Morken at the Mobile Ecosystem Forum: “Our task over the coming decades is to raise the payload capacity of messages so they convey more meaning, more reliably, to more people.”

The dual-class structure gives Morken outsized voting power relative to his economic stake. Insiders collectively own only 2% to 3% of shares, but through this structure Morken maintains decisive control. A founder with relatively modest economic ownership but disproportionate voting control creates a governance imbalance that can sit uneasily with minority shareholders. But to judge this arrangement purely by numbers is to miss that it is designed to preserve long-term orientation against the pull of short-term markets. A management team that must constantly appease quarterly expectations is unlikely to invest in multi-year projects like building a proprietary global network or designing an orchestration platform that will only bear fruit years later. The control structure gives Morken the latitude to pursue such projects, even if they depress margins in the near term.

This is not to say the arrangement is risk-free. Shareholders are essentially placing a bet on Morken’s character and judgment. If he were to lose discipline, or drift into value-destructive strategies, there is little minority investors could do to course-correct. This asymmetry underscores the importance of assessing not only financial metrics but the intangible qualities of leadership such as intellectual honesty, frugality, and commitment to customers.

In Morken’s case, the evidence thus far suggests a leader who has resisted temptations that would have enriched him personally at the expense of the enterprise. He did not take the company public prematurely, avoided splashy acquisitions, and recently repurchased convertible debt at a discount rather than using cash for cosmetic share buybacks. These are signs of economic rationality and long-term stewardship.

The same philosophy of disciplined, mission-oriented leadership has radiated through the organization. Bandwidth’s “Whole Person Promise” embodies this approach, emphasizing physical, mental, and spiritual wellbeing, with programs like 90-minute workout lunches, total disconnection during time off, and voluntary access to chaplains. Multiple awards, such as Best Places to Work and Customer Service Department of the Year, speak to the sculpted culture and external validation of how Bandwidth treats both its employees and customers.

Employee sentiment mirrors this in raw, visible ways. With a CEO approval rating in the top 10% of comparable firms, Bandwidth also earns a 3.8 out of 5 on Glassdoor across hundreds of reviews.

Source: comparably.com

This does not mean unanimous acclaim. Some employees have flagged issues like uneven middle management and a strict return-to-office policy, which felt out of step in a remote-work era. The culture is distinctive, but that also means it may not scale easily as the company grows globally. The broader story remains one of a unique culture that strikes alignment between values and execution.

The most tangible evidence of this discipline-to-culture ethos is its people infrastructure. In 2023, Bandwidth doubled down on its commitment to cohesion by investing in a 500,000-square-foot headquarters, built not merely as an office, but as a space for connection, creative collaboration, and shared purpose. In an era when many tech firms retrenched from physical spaces, Bandwidth doubled down, signaling that creativity and culture thrive in proximity when stewarded with intent.

Leadership who perseveres through crises, origins shaped by service, not flash and a culture that rewards whole-person alignment are the intangible capitals of compounding businesses. Morken’s more than two-decade tenure, the camaraderie of Bandmates, and the balance of spiritual and operational rigor are rare corporate currencies and, if upheld, can pay dividends for decades.

Capital Allocation

If management and culture reflect the spirit of the company, capital allocation reflects its discipline in action. Bandwidth’s history shows a pattern of careful stewardship rather than reckless pursuit of scale. For many years before its IPO in 2017, the company grew without heavy reliance on outside capital, an unusual feat in the software-communications space where many peers leaned heavily on venture backing. This conservatism has cut both ways. Bandwidth has avoided the worst pitfalls of overfunded competitors, but it has also been slower to build broad developer mindshare in the way Twilio did.

The most consequential capital allocation decision in its history was the 2020 acquisition of Voxbone, which extended its global network and regulatory footprint. The deal came with debt, raising leverage, but it also provided the infrastructure that underpins Bandwidth’s current positioning as a global enterprise-grade platform. Investors may debate the price paid, but the strategic rationale is clearer in retrospect. Without Voxbone, Bandwidth could not credibly serve multinational enterprises or build the Maestro platform that aims to orchestrate communications across jurisdictions.

Source: pulse2.com

Today, free cash flow is positive and growing, with roughly $59 million generated in 2024. Management has directed this cash toward two main uses: reinvestment in network and software capabilities, and gradual deleveraging. In May 2024, for instance, Bandwidth repurchased a portion of its convertible notes at a discount, simultaneously reducing debt and recording an accounting gain. This decision demonstrates opportunism in capital allocation, a willingness to retire liabilities cheaply when the market offers the chance.

The company does not currently pay dividends, and given its stage of development, this is rational. Every dollar reinvested in strengthening the network, expanding Maestro, or deepening enterprise integrations carries a higher expected return than distributing cash to shareholders. Stock-based compensation remains a more ambiguous issue. While not excessive by software-industry standards, it absorbs a meaningful share of free cash flow. Management has signaled moderation here, with stock-based comp trending lower as earlier large grants vest out.

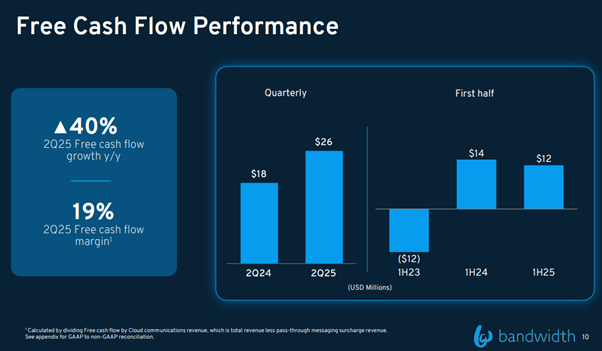

The numbers show a turning point. In the Q2 2024, Bandwidth recorded $11.4 million in stock-based compensation versus $18.3 million in free cash flow production. This improved sharply in current year, where free cash flow in the Q2 2025 was $25.6 million, double the quarterly SBC expense of $12.5 million in the same period. It demonstrates that the business is now producing substantial cash even after dilution is accounted for, a marked improvement from prior years when SBC could consume most of the reported cash generation.

The trend appears to be heading in the right direction. Earlier grants made during the IPO and post-acquisition period are vesting out, and management has shown signs of restraint in issuing new awards. A company whose true owner earnings grow faster than the pace of dilution compounds value meaningfully over time. For Bandwidth, the evidence suggests that it is crossing that inflection.

The capital allocation record suggests a team that prioritizes strategic necessity and long-term resilience over short-term appeasement of markets. Debt is high, yes, but manageable, and free cash flow is already funding its reduction. Reinvestment is disciplined, focused on network reliability and product expansion rather than scattershot acquisitions. If management maintains this posture, Bandwidth has the financial foundation to grow into the kind of compounding business its culture aspires to support.

Financials and Valuation

Valuation is always a fraught exercise. Numbers can be precise, yet the future they purport to describe is not. What matters is whether we are paying a sensible price for a business that can compound over a long period. In the case of Bandwidth, the market has already stripped away optimism. The stock is priced as though growth will stagnate and margins will remain permanently suppressed. Against such a backdrop, even modest success can lead to significant reappraisal.

Current Market Metrics

At a share price of roughly $15, Bandwidth’s equity value is near $450 million. With net debt of about $400 million, the enterprise value stands close to $850 million. On 2024 revenues of ~$749 million, this equates to just over one times sales. On an EBITDA base of $82 million, it works out to ~9x EBITDA. On free cash flow of ~$59 million, the multiple is approximately 14x. Net income remained slightly negative, at around negative $6.5 million, due largely to non-cash charges including stock-based compensation and amortization from prior acquisitions. On a cash basis, the company is firmly profitable.

These figures are extraordinary when set against the broader technology and communications landscape. Companies with shrinking revenues and questionable futures sometimes deserve such multiples. Yet Bandwidth is still growing with 10% guidance for 2025 and operates in an industry expanding at nearly 30% annually. It is not a declining asset, but the market prices it as though it were.

Peer Comparison

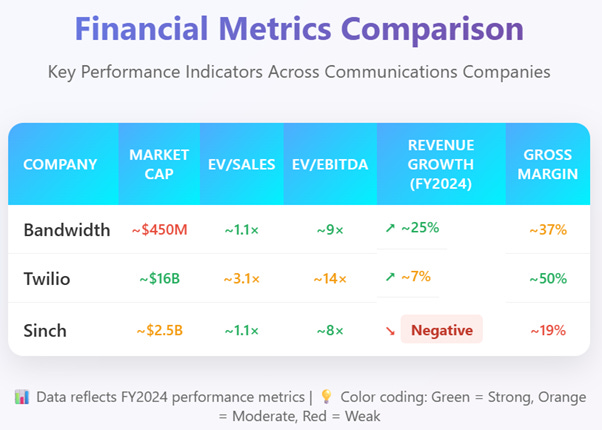

Consider Twilio, the most recognized CPaaS name. Its growth has slowed to the mid-single digits and yet it trades at around 3x sales. Sinch in Europe, wrestling with pricing pressure challenges, trades at a similar 1.1x sales. Vonage was acquired by Ericsson at multiples well above 4x. The discrepancy between Bandwidth and its peers is glaring.

Even mature telecom infrastructure firms, burdened with low growth and heavy capital intensity, frequently trade above one times sales. Bandwidth, with its hybrid model of owned infrastructure and software orchestration, deserves at least this level if not higher.

A comparative table brings the point into sharper relief.

What stands out is that Bandwidth trades at a steep discount to peers despite being free cash flow positive and despite possessing structural advantages that others lack.

Beyond peer comparisons, one must ask what the business might earn at scale. The CPaaS market is projected to exceed $70 billion by 2030. If Bandwidth merely maintains its current market share of 3% to 4% share, it could generate over $2.5 billion in revenues. Assuming margins improve toward 15% as higher-value services gain traction, cash flow could exceed $250 million annually.

Applying a conservative 2x multiple to sales gives a ~$5 billion valuation, more than 10x the present market capitalization. Discounted back, this implies an internal rate of return above 20% annually. That is the upside if the company simply grows with the market and captures the benefits of scale.

Scenario Analysis

To anchor expectations, we can sketch three broad scenarios.

Bear Case. Growth slows to 5%, Maestro and AI services fail to scale, and gross margins remain stuck near 40%. Revenue reaches only a billion by 2030, EBITDA margins stay near 10%, and the market values the company at around today’s enterprise value. In this case, the stock returns little, though downside is limited given existing cash generation.

Base Case. Growth averages ~10%, Maestro gains moderate adoption and revenues reach about ~$1.3 billion by 2030. At ~2x sales, valuation could approach ~$2.6 billion, implying a 3x to 4x from current levels.

Bull Case. The strategic shift succeeds beyond expectation. Bandwidth becomes the orchestration layer of choice for Global 2000 enterprises, capturing 5% of a $70 billion CPaaS market. Revenue rises toward $3.5 billion, with ~15% free cash flow margins generating ~$525 million of FCF annually. Even a conservative multiple of twenty times FCF would value the equity at ~ $10.5 billion, implying a 20x increase from today.

The market today is pricing something closer to the bear case. Investors are acting as though stagnation is inevitable. Yet the business is delivering growth, generating cash, and investing in higher-value offerings. The asymmetry is striking: the downside appears limited while the upside is significant.

Margin of Safety

Every investment requires a margin of safety. In Bandwidth’s case, it comes from the current valuation. Even if growth underwhelms, the stock is unlikely to collapse further when priced at less than 1x sales and ~7x free cash flow. On the other hand, if the company executes moderately well, the potential for multiple expansion is considerable.

The market believes Bandwidth will remain a low-margin commodity player. If reality proves even modestly better, the rerating will be substantial.

Risks and Pre-Mortem

All investments carry risk. The task is not to avoid it altogether, but to understand its nature and scale, and to determine whether the potential reward justifies its embrace. With Bandwidth, the market’s discount already reflects a fair measure of skepticism. Yet risks remain that could erode or invalidate the long-term thesis.

Competitive Pressure

The CPaaS industry is crowded with formidable players. Twilio, despite its slowing growth, commands scale and developer mindshare. Sinch, Vonage, and a host of regional players compete for similar enterprise customers. More importantly, hyperscale cloud providers such as Microsoft Azure, Amazon Web Services, and Google Cloud offer communications services bundled with broader infrastructure.

These giants possess distribution networks and balance sheets that Bandwidth cannot match. They could undercut pricing, bundle services into larger contracts, or simply absorb CPaaS into their ecosystems. If enterprises perceive little difference in quality or regulatory expertise, Bandwidth’s differentiation could diminish.

Mitigation lies in its carrier-grade infrastructure and focus on reliability. Hyperscalers may not wish to replicate decades of telecom investment and licensing. Bandwidth can partner with them, as it already does with Microsoft, supplying the regulated network layer while the cloud providers manage applications. Success depends on making itself indispensable in this role.

Margin Stagnation

A central part of the thesis is that margins will expand as the mix shifts toward higher-value services like Maestro and AIBridge. If these offerings fail to gain traction, margins may remain trapped in the high-30s, leaving Bandwidth valued as a commoditized telco.

The danger is that the flywheel stalls. Customers continue to use Bandwidth for cheap minutes but allocate their strategic spending elsewhere. In this case, the stock could remain depressed for years, offering little return.

This warrants careful monitoring of gross margin trends. The past year has shown modest improvement. Continued upward movement would signal that the shift in product mix is real. Flat or declining margins over several years would suggest the moat is less powerful than believed.

Leverage and Balance Sheet Risk

Net debt of over $400 million is not trivial for a company of Bandwidth’s size. With EBITDA of $80 million, leverage sits near five times, which limits flexibility. A downturn in usage or a spike in interest rates could place strain on the business.

Management has begun reducing debt, including repurchasing convertible notes at a discount. Free cash flow covers interest comfortably today, but investors must watch whether deleveraging proceeds steadily.

Regulatory Complexity

Operating as a licensed carrier in more than sixty countries exposes Bandwidth to shifting regulatory landscapes. Telecom is heavily policed: rules for emergency calling, spam prevention, data privacy, and number portability change frequently. Missteps can result in fines or reputational damage.

While regulatory expertise is itself a moat, it also creates ongoing cost and risk. A sudden regulatory shift, such as new taxes on VoIP services or harsher penalties for compliance failures, could erode margins.

Execution Risk

The company is evolving from a utility-like network operator to a software platform. This demands new skills in enterprise sales, product development, and global integration. Cultural growing pains are possible, especially as the workforce has doubled since the Voxbone acquisition.

If Bandwidth fails to attract top technical talent or cannot sell effectively into Forbes’ Global 2000 accounts, the transformation may falter. In that case, the company would remain a competent network operator but fail to capture the higher-margin platform opportunity.

The value of this pre-mortem is not in predicting which scenario will unfold but in highlighting early warning signs. If net retention falls below 100%, if gross margins plateau, if debt reduction stalls, or if customer wins slow, then caution is warranted.

Catalysts

Investing with a long horizon requires patience, but patience does not preclude attentiveness. The market often awakens to value not gradually but in bursts, triggered by specific developments that shift perception. For Bandwidth, several such catalysts lie ahead, each with the potential to unlock a higher valuation or accelerate recognition of its business transformation.

Adoption of Maestro and AI Voice Services

The pivot from commodity minutes to orchestration and AI enablement is the heart of the investment case. Evidence that this pivot is working would command attention. If Bandwidth announces that a Fortune 100 company standardized on Maestro to manage global communications, or that a major bank is deploying AIBridge to power AI-driven customer calls, investors will reassess the company’s place in the value chain.

These wins need not be measured only in dollars. Milestones such as integrations with leading AI platforms or partnerships with major contact centre providers would be equally powerful. They would signal that Bandwidth is becoming the connective tissue of enterprise communication rather than just a carrier in the background.

Margin Expansion

The market has long discounted Bandwidth for its lower margins. Any clear evidence of improvement would challenge this narrative. Gross margin moving beyond 40% and EBITDA margin consistently rising into the mid-teens % would show that the flywheel is turning.

The company has already reported modest sequential increases. Sustained progress could spark a rerating, as investors recognize that the asset-heavy model is not a handicap but a moat. A quarter or two of surprising margin improvement could catalyze a rapid stock response.

Deleveraging the Balance Sheet

Leverage is a visible overhang. The company’s net debt invites caution, particularly from institutions that demand conservative financials. Progress in reducing this burden, whether through continued free cash flow application, opportunistic note repurchases, or refinancing on better terms would materially improve sentiment.

If debt falls by even a $100 million over the next two years, leverage ratios would improve substantially, lowering perceived risk and allowing valuation multiples to expand. The market’s memory is short; it needs only a few quarters of steady deleveraging to regain confidence.

Strategic Partnerships

Bandwidth already serves as a network partner for Microsoft and others. Deeper partnerships or official endorsements could reshape investor expectations. Imagine Microsoft designating Bandwidth as a preferred provider for Operator Connect, or Amazon AWS integrating Bandwidth services into its enterprise suite. Such announcements would validate the niche Bandwidth occupies and provide visibility of future growth.

In industries where trust and reliability are paramount, partnerships carry signaling power. They reassure customers and investors alike that Bandwidth is not just another vendor but an integral component of the digital infrastructure.

Industry Consolidation

The CPaaS landscape is fragmented. In recent years, Vonage was acquired by Ericsson for billions, and Sinch has pursued serial acquisitions. If consolidation continues, Bandwidth could either be acquired or see its valuation buoyed by peer transactions.

An acquisition at 3x to 4x sales, consistent with past deals, would imply a price far above today’s levels. Even rumours of such activity could lift sentiment. While not central to the thesis, this optionality is real and underappreciated.

My View

The task of investing is often portrayed as a contest of prediction. In truth it is less about guessing the immediate and more about discerning the enduring. In the case of Bandwidth, what endures is the human need to communicate, the corporate imperative to connect with customers, and the inexorable migration of these exchanges into the cloud. The company is positioned at the junction of these forces, neither glamorous nor loud, but essential.

The stock market has judged it harshly. It trades at a fraction of peers on sales and cash flow, as if its future is little more than a struggle to survive. Yet beneath this skepticism lies a founder-led company with a genuine moat in its owned network, a culture that has so far balanced discipline with innovation, and a strategy that invests scale back into the customer relationship. This is the quiet work of building trust, which compounds invisibly until one day it appears immovable.

Conviction, however, must be tempered by realism. Bandwidth is not yet proven as a compounding machine of the highest order. Debt burdens weigh, competition looms, and cultural transformation from telecom to software is unfinished. These factors argue against outsized exposure. Prudence demands that the position begin small. Such a stake secures participation in the upside without undue risk should the thesis falter.

Over time, the company will earn its place in the portfolio through evidence. Each quarter of margin improvement, each dollar of debt reduced.

If Bandwidth captures even a modest portion of the CPaaS market and scales its software services, the potential value is many multiples of today’s market capitalization. If it fails, the downside is cushioned by real cash flow and tangible assets.

In Bandwidth, time will be the judge, and we need only sit with it.

I’m sharing information here to educate and inform, not to provide financial or investment advice. Like any other personal financial matter, your own due diligence is paramount.

BAND fundamentals look compelling—curious to see if the market starts pricing in the upside soon.

Thanks, glad u see value too, will just be a matter of time is my guess 🙂